Introduction:

The newly amended Implementing Regulations of the Chinese Patent Law ("New Regulations"), effective from January 20, 2024, have brought significant changes to the legal framework surrounding awards and remunerations for service inventions. While the lawmakers say these amendments were intended to harmonize lower-level regulations with superior laws, thereby enhancing the legal system for employee inventions, it also means increased burden or risks for companies doing R&D in China, whether domestic or international companies. This article delves into these changes, outlines potential legal risks, and provides compliance recommendations for employer entities operating under Chinese jurisdiction.

Key Changes in Awards and Remunerations:

The New Regulations have increased the statutory standard for awards for service inventions and made substantial modifications to the remuneration-related provisions. These adjustments align with Article 15 of the Patent Law, which mandates that the employer awarded a patent must award the inventor for their service invention and provide reasonable remuneration for the commercialization based on the scope of the implementation and the economic benefits derived. To be specific:

1. Awards for Service Inventions

The minimum award for an invention patent has risen from RMB 3,000 to 4,000 and for a utility model or design patent from RMB 1,000 to RMB 1,500.

2. Remunerations for Service Inventions

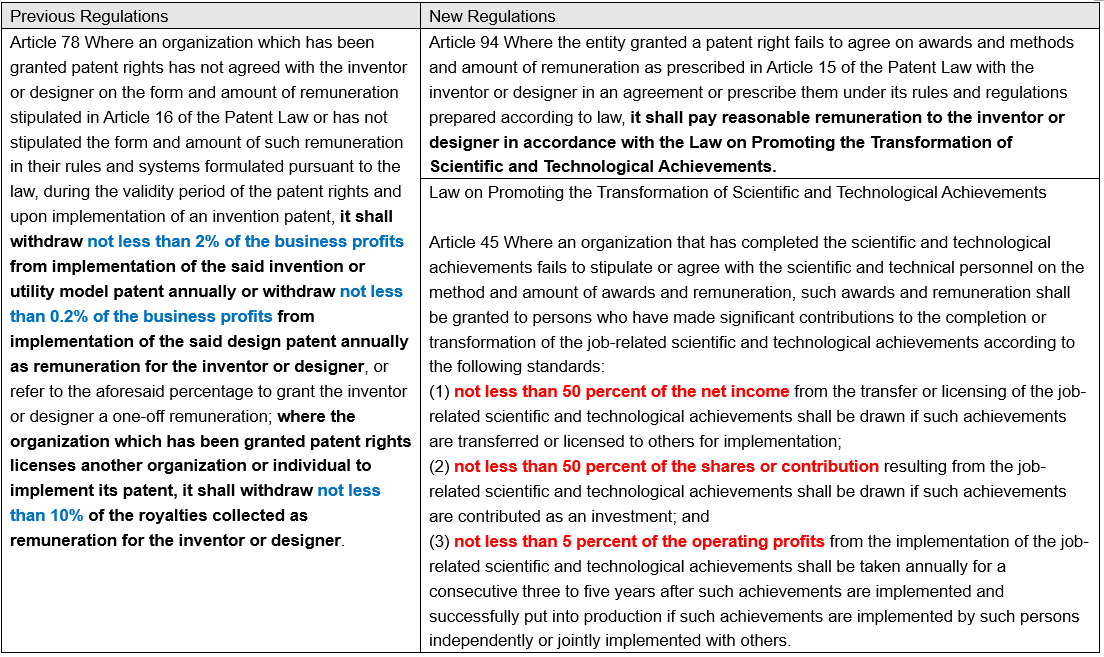

Regarding remuneration for service inventions, the New Regulations have significantly raised the standards, referring to the relevant criteria outlined in the "Law on Promoting the Transformation of Scientific and Technological Achievements" as the basis for calculating remuneration. Specific changes are set out below:

The standard has been raised from "10%+ of the royalties for licensing to others" to "50%+ of the net income from licensing or transferring", and from "2%+ (for inventions or utility models) or 0.2%+ (for designs) of the annual business profit after implementation" to "5%+ of the annual operating profits for a continuous period of three to five years after commencement of production". This shift in the remuneration calculation method not only addresses inconsistencies between subordinate and higher-level laws but also raises the remuneration amount proportion and involves a broader range of contributors.

3. Introduction of New Award/Remuneration Mechanism

The award/remuneration mechanism now formally includes the profit-sharing mechanisms such as equity, stock options, and dividends which have already been adopted in practice. This provision offers employers a flexible and diverse range of methods, enabling inventors to share innovation profits reasonably. This, in turn, encourages innovation and promotes the commercialization, implementation, and application of patents.

Overview of the Trends in the Subject Matter Amounts in Service Invention Remuneration and Award Cases over the Past Decade

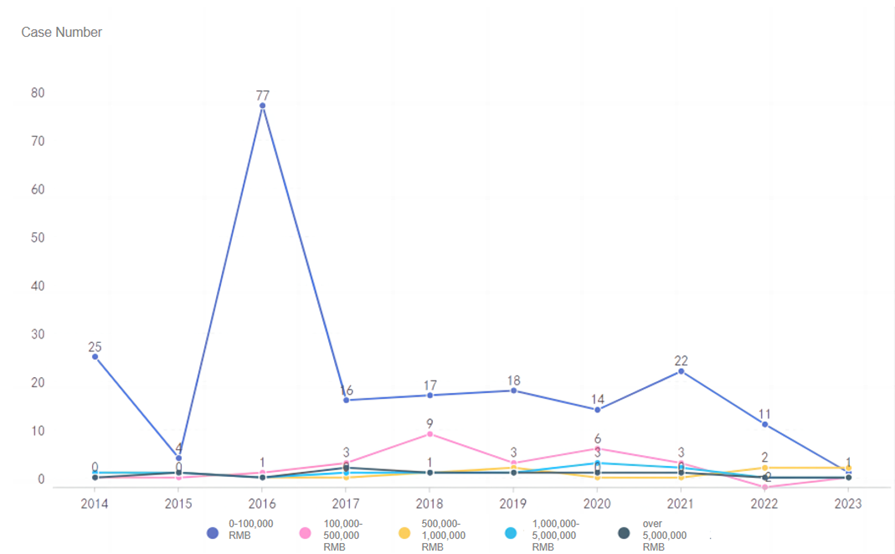

We searched for the subject amounts of relevant cases over the past decade in the judicial database using the keywords "service invention, award, remuneration” and summarized them into the figure below.

Based on the above data, we have observed the following trends:

1. From 2016 to 2019, there was a significant rise in disputes over awards and remunerations for service inventions.

2. In the public cases of the last decade, between 2016 and 2017, disputes over awards and remunerations for service inventions involving amounts of RMB 10,000 to 100,000 accounted for the vast majority of such cases, with a proportion exceeding 70%. From 2018 to 2020, the proportion of cases involving amounts of RMB 10,000 to 100,000 decreased, while cases with claimed amounts in the millions witnessed an increase; in the past three years, the number of related cases has decreased (which may be attributed to a reduction in the number of judicial documents made available to the public).

3. Overall, the claimed amounts of disputes over awards and remunerations for service inventions are relatively small, with cases involving claimed amounts in the millions or even tens of millions constituting only a single-digit percentage of the total.

Regarding whether the implementation of New Regulations will lead to changes in judicial practice, it remains to be seen, as the New Regulations have been implemented for less than three months.

Compliance recommendations based on New Standards:

1. Establishing Specific Rules for Service Invention Awards and Remuneration Based on New Standards in the Absence of Policies/Agreements

If the employer has not yet established or agreed upon specific rules for service invention awards and remuneration, they should be set or agreed upon in accordance with the New Regulations. The employer can either negotiate specific rules individually with each employee or establish them in the form of internal policies or do both.

It is important to note that if the awards and remuneration for service invention are specified by internal policies, the following key requirements shall be met to ensure the policies’ legality and effectiveness:

Procedural Compliance: the policy shall be discussed by the employee representatives congress or all staff who may make a proposal and give their opinion and the employer shall conduct fair negotiation with the labor union or employee representatives before making a decision. During the implementation of the internal policies, if the labor union or employees find them inappropriate, the employer should establish a mechanism for them to suggest modifications and improvements through further consultation.

Notification: the employer should publicize or inform the employees about these policies, such as publicizing the policies within the company, posting them on the company's intranet, and including them in an updated employee handbook for everyone to sign off.

Content: the policy must be carefully drafted to ensure it does not contravene current laws, regulations, or administrative rules.

In the event of relevant disputes, the employer should bear the burden of proof and demonstrate that the policies it has formulated comply with the aforementioned procedural requirements.

2. Broader Scope of Beneficiaries:

Under the New Regulations, not only inventors but also individuals contributing significantly to the transformation of scientific and technological achievements are entitled to remuneration. The employer is advised to clearly define the roles and contributions of all involved parties to avoid ambiguity and potential conflicts.

3. Setting Reasonable Standards:

While the employer’s internal policies or contractual arrangements with employees take precedence over statutory standards, allowing for some flexibility beyond the direct application of the statutory standards, it is crucial to bear in mind that any significant deviation from the statutory standards may be subject to judicial scrutiny if employees challenge the fairness of these policies or agreements. In such cases, the courts may adjust the amount of awards and remuneration for service inventions based on the principles of fairness and reasonableness if the employer cannot provide any justifiable reasons. Therefore, the employer should establish clear and reasonable rules or contractual provisions. Companies are also advised to retain detailed documentation on how the awards and remuneration are calculated, such as calculating based on the average value of inventions in the same field. In addition, if the company’s internal monetary standard falls below the statutory level, it is recommended to include additional benefits such as stock options, promotions, salary increases, or paid leave as part of the service invention awards and remuneration, which may enhance the rationality of company’s award/ remuneration standard.

4. Equity and Profit-Sharing Incentives:

National policy encourages entities to implement equity-based incentives, such as stock options and dividends, to allow inventors to share in the innovation proceeds. Entities may explore these options to align with national policy and motivate their research and development personnel.

Other FAQ/suggestions regarding Service Invention Awards and Remuneration

1. Is the statutory standard for service invention awards and remuneration calculated per patent or per inventor?

It is calculated per patent. As per precedents, when a patent involves multiple inventors, the awards and remuneration should be divided among the inventors according to their respective contributions, rather than each inventor receiving an individual award based on statutory standards. Moreover, in the absence of evidence proving different levels of contribution, courts tend to assume equal contributions and distribute the awards and remuneration evenly among inventors.

2. If an employee working for a Chinese subsidiary of a multinational corporation creates an invention and a corresponding patent application is filed by its foreign affiliate, or the patent is transferred to its foreign affiliate, is the Chinese subsidiary still obligated to provide the employee with service invention awards and remuneration?

Yes, the Chinese subsidiary is still obligated to pay service invention awards and remuneration to the inventor employees. Service invention awards and remuneration have the nature of labor remuneration. The legislative intent behind the provisions on service invention awards and remuneration is to provide inventors with deserved labor compensation, which is a legal obligation of the employer, and cannot be avoided by transferring patent rights.

3. Does it still need to pay service invention awards and remuneration after a patent has been declared invalid?

Yes, fees still need to be paid, if the situation falls under the exceptions outlined in Article 47 of the Patent Law, where the invalidation does not have a retroactive effect on judgments, mediation documents, or decisions regarding patent infringement disputes that were already made and enforced, or on patent licensing/transfer agreements that have been performed. This is because the employer still benefits from the invention through licensing, transfer, or implementation, and it is reasonable to pay remuneration to the inventor based on the benefits already gained from these activities.

However, if the situation does not fall under these exceptions (where the invalidation has a retroactive effect), then the inventor loses the basis to demand awards and remuneration.

4. Is it valid for a company's policy to state that employees will no longer receive invention awards and remuneration after they leave the company?

No, it is not valid. The obligation to pay invention awards and remuneration is a legal obligation and cannot be waived through internal policies or contractual agreements.

5. Should the employer include damages won through lawsuits concerning the patented invention when calculating invention awards and remuneration (in the absence of prior policies or agreements regarding invention awards and remuneration by the employer)?

Based on precedents, damages obtained by the employer from patent-related litigation are considered income derived from the patent. After deducting necessary litigation costs and expenses, these financial gains should be treated as business profits and a reasonable invention remuneration should be calculated and provided to the inventor accordingly.

6. Other suggestions

(1) For patents developed in collaboration with third parties, it is advisable to specify in the contract that each party is responsible for awarding and compensating their own employees for any inventions they make during the collaboration, in order to avoid unnecessary disputes.

(2) In large-scale companies, where hundreds or even thousands of patents are generated annually, and each patent may generate varying amounts of income from implementation, it would be too costly for the company to individually negotiate invention awards and remuneration with employees for each patent. In this regard, it is suggested to establish rules for service invention awards and remuneration through the company’s internal policies. Moreover, when employees receive payments, it would be better to have them confirm that they have received the awards and remuneration for the specific patent. Additionally, it's recommended to provide remuneration for service inventions during the patent application stage when it is not clear whether the patent will be implemented or how much income it might generate. Through this approach, employees are likely to understand that the company takes on the mentioned risks, reducing the likelihood that they may dispute the amounts of invention awards and remuneration.

(3) For particular projects where the company opts to set invention awards and compensation based on specific circumstances, it is recommended that the company meticulously document the project implementation, conduct thorough project cost accounting, and consider various factors such as the company's actual profits and other implementation circumstances. This ensures better preparedness to address potential challenges regarding the reasonableness of remuneration calculation methods. Especially in cases where service invention licensing or transfer occurs between affiliated companies, the fees specified in such agreements might be difficult for the court to recognize.

Conclusion:

The New Regulations herald a new era of increased incentives for service inventions in China, aiming to foster innovation and award inventors fairly. Employers need to carefully analyze these changes to minimize risks and ensure compliance. Additionally, employers should also pay close attention to judicial practice and adapt their approaches accordingly. By taking these steps, employers can position themselves favorably within the framework of the revised Patent Law and maintain their competitive edge in leveraging intellectual property assets.

* * * * * *

For tailored guidance and legal support in adapting to these changes, it is advisable to consult with intellectual property law professionals with expertise in Chinese patent law.

This article is provided for informational purposes only and does not constitute legal advice. Entities should seek professional legal counsel to address specific issues and compliance requirements under the New Regulations.

*Special thanks to our intern Xin Chen for her invaluable contributions to this article.

Relevant Personage

-

Simon Du Shanghai

Simon Du ShanghaiPractice Areas: Intellectual Property , Unfair Competition , Trade Secret , Corporate Compliance

-

Jerry Xia Shanghai / US Liaison Office*

Jerry Xia Shanghai / US Liaison Office*Practice Areas: Intellectual Property , Technology Transactions , Dispute Resolution , Merger & Acquisition , Regulatory Compliance , Policy Advocacy